How to Find a Dental Marketing Agency That You Can Trust

Posted on 1/24/2026 by WEO Media |

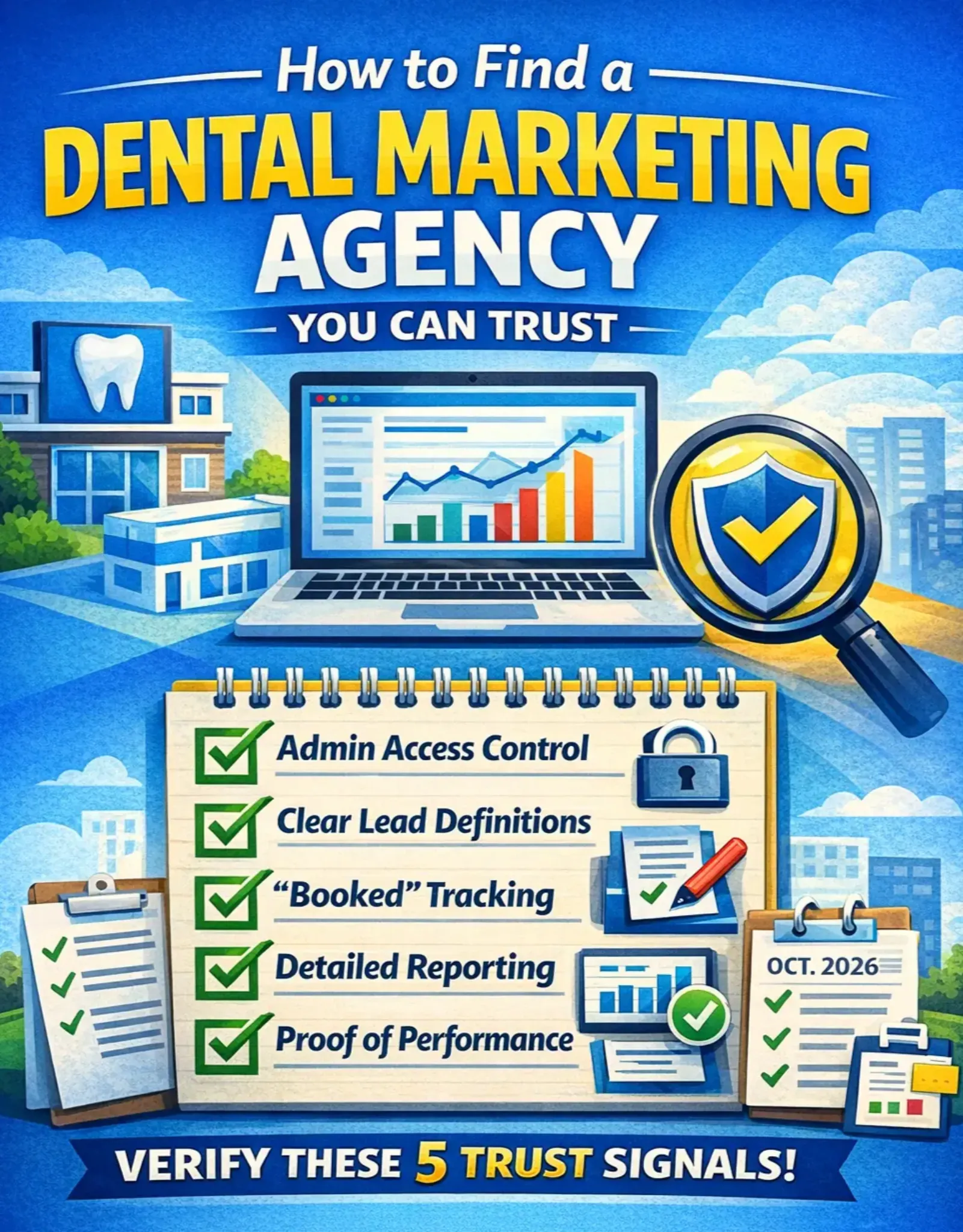

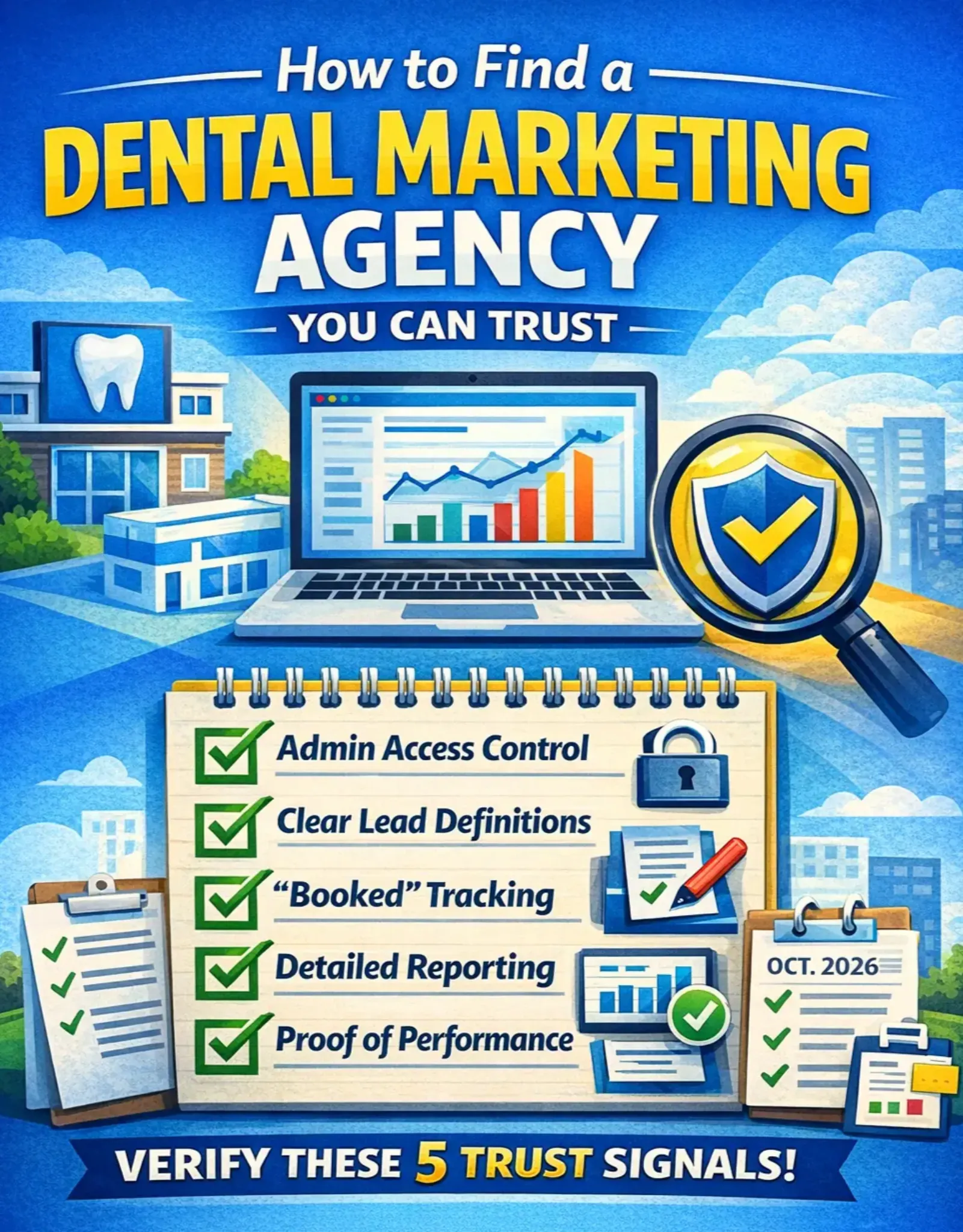

To find a trustworthy dental marketing agency, verify five trust signals before you sign: (1) you have admin ownership of the key accounts, (2) “lead” and “qualified lead” are defined in writing, (3) “booked” is defined in writing, (4) reporting connects leads to bookings with leakage metrics (not vanity metrics), and (5) the agency can show dated proof of work (change logs, QA notes, decision notes) and explain exactly what happens when tracking or listings break. To find a trustworthy dental marketing agency, verify five trust signals before you sign: (1) you have admin ownership of the key accounts, (2) “lead” and “qualified lead” are defined in writing, (3) “booked” is defined in writing, (4) reporting connects leads to bookings with leakage metrics (not vanity metrics), and (5) the agency can show dated proof of work (change logs, QA notes, decision notes) and explain exactly what happens when tracking or listings break.

If an agency can’t verify access, won’t define lead quality, or can’t produce proof artifacts, you’re not choosing a partner yet—you’re choosing uncertainty.

By the end, you’ll have a checklist to compare agencies side-by-side, plus discovery-call questions that confirm access, definitions, proof artifacts, and how they handle failures.

TL;DR

Finding the Best Dental Marketing Agency

Use this quick test to screen agencies fast:

| 1. |

Verify ownership - You have admin access to domain and DNS, Google Business Profile (GBP), Google Ads, GA4, GTM, Google Search Console, listings management tools (if used), and call tracking.

|

| 2. |

Define lead quality - “Lead,” “qualified lead,” and exclusions are documented by service line.

|

| 3. |

Define “booked” - Booking rules are written and tied to what’s schedulable.

|

| 4. |

Require outcome reporting - Reporting connects leads to booked and showed, includes answer rate and callback speed, and explains what changed and why.

|

| 5. |

Confirm proof artifacts and a failure plan - They can show dated change logs plus one monthly decision note, and explain what happens if tracking or GBP breaks. |

Proof artifacts matter because they show what changed, when it changed, and what moved afterward—so performance isn’t just a story. For example, a good decision note might read: “01/15 – Added negative keywords for insurance-only searches; qualified leads decreased, but booking rate improved over the next two weeks (and missed-call rate stayed flat).”

If you can verify those five trust signals, you can compare agencies calmly. If you can’t, stop and fix the foundation first.

This guide is written for owners and office managers who want control (access, definitions, proof), not another vendor pitch.

Table of Contents

What Trust Means in Dental Marketing

Trust is practical, not philosophical. In dental marketing, it shows up in four places you can observe: access (who controls the accounts), definitions (what counts as a qualified lead and a booking), documentation (proof of what changed and when), and behavior under pressure (how the agency responds when results change or tracking breaks). Tone matters too—pushy messaging can increase volume while lowering patient confidence.

Outcome reporting answers three questions: what happened, why, and what we’re changing next—with monitoring and a rollback plan. Activity reporting lists tasks without connecting them to lead quality or booked appointments.

Trust check in 60 seconds using this call script:

| • |

Ask for access proof - “Can you show my email in the User Access screen for Google Ads, GA4, GTM, GBP, and Search Console?”

|

| • |

Ask for one real artifact - “Show me a change log entry plus a decision note from last month with dates and outcomes.”

|

| • |

Ask for their failure playbook - “What’s your step-by-step when calls stop tracking or a GBP listing is suspended?”

|

| • |

Ask how they connect marketing to the schedule - “How do you reconcile leads to booked to showed without sharing PHI?” |

Tip: Have your practice email ready so they can show your role in each platform during the call.

> Back to Table of Contents

Ownership and Admin Access: The Non-Negotiables

Ownership is how you prevent lock-in—and verify what’s true. If the practice cannot independently confirm access and data, it becomes difficult to validate performance, troubleshoot problems, or transition vendors safely.

This isn’t branding—it’s control of access, definitions, and outcomes.

What the practice should control

If you don’t control these, you’re renting your own marketing system.

| • |

Domain registrar and DNS - Control of the site’s continuity and critical records.

|

| • |

Google Business Profile ownership - Owner-level access so listings can be governed and recovered if issues occur.

|

| • |

Google Ads account - Admin access to Google Ads and any paid platforms used.

|

| • |

Analytics and tagging - GA4 and GTM access so tracking stays consistent over time.

|

| • |

Search Console - Visibility diagnostics and indexing checks.

|

| • |

Call tracking - Clear number ownership or portability policy, routing rules, and de-duplication approach. |

Admin access must be visible in the platform’s user list with your email and role—not implied by results. Ask for a screenshot of the User Access and Permissions screen in each platform showing your internal email with the correct role—not a PDF report of results.

Access verification SOP for the practice

| 1. |

List each platform and record owner and admin emails for domain, GBP, Google Ads, GA4, GTM, Search Console, listings, and call tracking.

|

| 2. |

Ensure at least two internal admins have access for continuity during staff turnover.

|

| 3. |

Enable multi-factor authentication and remove shared logins where possible.

|

| 4. |

Document call routing rules, after-hours handling, and online booking links.

|

| 5. |

Run an end-to-end test for call, form, and booking and write down what should fire where. |

If access cannot be verified quickly, that is not a small onboarding delay. It is a structural risk that affects measurement, continuity, and security.

> Back to Table of Contents

2-Minute Risk Check: If You Only Do Three Things

Now that you know what trust looks like, here’s the fastest way to reduce risk this week.

| • |

Own the assets - Domain, GBP, Google Ads, GA4, GTM, Search Console, listings, and call tracking.

|

| • |

Define quality - Lead, qualified lead, exclusions, and service-line rules tied to what’s schedulable.

|

| • |

Measure leakage - Answer rate, callback speed, follow-up, and booking friction before scaling spend. |

If your phones ring and your team can’t answer, “more leads” is not a win—it’s stress. Good marketing protects the front desk by improving intent, routing, and follow-up so demand becomes bookings, not chaos.

> Back to Table of Contents

Fast Self-Assessment: Pick the Right Agency Type

The right partner depends on goals, constraints, and operational reality. Start by matching channel priorities to patient intent and what your team can support.

Goal to channel to metric decision tree

| • |

Local new patients - Emphasis on local visibility, GBP accuracy, and conversion-ready pages; track qualified calls and booked new-patient slots.

|

| • |

High-value procedures - Procedure pages, qualification rules, consult conversion paths; track consult bookings and show rate.

|

| • |

Retention and reactivation - Recall and consent-governed messaging; track reactivated appointments.

|

| • |

Multi-location growth - Standardized tracking and location governance; track booked outcomes by location with consistent definitions. |

If your pages, ads, and intake process don’t match real query intent, platforms can still produce volume—often at lower quality and higher cost.

Operational readiness: what marketing cannot fix alone

| • |

Capacity mismatch - Demand increases without available slots, creating staff stress and lower booking rates.

|

| • |

Call handling gaps - Missed calls and slow callbacks erase gains even when lead volume rises.

|

| • |

Approval friction - Multi-doctor approvals without defined lanes delay execution.

|

| • |

Follow-up inconsistency - Leads go cold without a clear callback and appointment-request Service Level Agreement (SLA). |

A healthy relationship feels structured week to week: clear owners, predictable approvals, and a shared definition of what matters. If a partner pushes messaging your team would not say in a consult, culture fit is off—even if the creatives look polished.

> Back to Table of Contents

Strategy First: Spot a Real Plan Not Just Tactics

A real strategy connects: ideal patient, positioning, channel mix, conversion path, follow-up system, and measurement. This matters because platforms optimize around the signals you feed them.

How local visibility typically works

Local visibility is mostly shaped by three factors: fit, proximity, and reputation.

| • |

Fit - Clear service and location relevance to what patients search.

|

| • |

Proximity - Accurate address signals and consistent NAP (Name/Address/Phone) data.

|

| • |

Reputation - Reviews and consistent public information across sources. |

On paid media, “fit” is controlled by keyword intent, negative keywords, landing page alignment, and feedback loops from lead quality—not just budget.

Conversion paths that protect patient trust and staff morale

| • |

Routing rules - After-hours handling, emergency triage, and missed-call recovery.

|

| • |

Expectation-setting - Consultation-first language that avoids overpromising.

|

| • |

Booking friction reduction - Simple forms and flows that work for low-tech users.

|

| • |

Follow-up SLAs (response time rules) - A documented timeline for callbacks and appointment requests. |

If early results fluctuate, the safest response is usually documented, limited-scope changes—paired with tracking checks so you are not optimizing based on broken measurement.

> Back to Table of Contents

Deliverables That Matter (And How to Verify Them)

Deliverables should be both useful and verifiable. A proposal is stronger when it specifies what will be produced, how it will be documented, and how it will connect to the KPI chain.

Dental SEO deliverables

| • |

Technical health - Indexation checks, redirect discipline, Core Web Vitals priorities.

|

| • |

Intent-mapped pages - Service and location pages aligned to patient queries.

|

| • |

Local foundations - Duplicate cleanup and NAP consistency.

|

| • |

Friction-reducing content - FAQs, financing and insurance clarity, and what to expect pages.

|

| • |

Ongoing diagnostics - Query and visibility reviews that lead to next actions. |

What to request: one audit note, one change log excerpt, and one “what changed, why, what’s next” decision note from the last 30 to 60 days.

Dental PPC deliverables

| • |

Intent control - Keyword mapping and negative keyword process.

|

| • |

Conversion alignment - Landing pages that match the query and set expectations.

|

| • |

Call-focused structure - Call routing, hours coverage, and call tracking validation.

|

| • |

Quality feedback loop - Lead-quality rules and dispositions that influence targeting.

|

| • |

Policy-safe messaging - Offer and claim review process tied to approvals. |

What to request: a search term review snapshot, a documented negative keyword update, and a change log entry tied to lead-quality outcomes.

Website and conversion deliverables

| • |

Launch safety - Staging, QA, redirects, and rollback triggers.

|

| • |

Tracking integrity - GA4 and GTM events defined, tested, and versioned.

|

| • |

Accessibility basics

- Readable forms and keyboard navigation support.

|

| • |

Conversion clarity - Calls, forms, and booking paths built for patient confidence.

|

| • |

Maintenance - Updates and monitoring cadence to reduce breakage. |

What to request: a launch QA checklist, a tracking test log, and a monitoring routine for broken forms and downtime.

Local and GBP deliverables

| • |

GBP governance - Categories, services, and edits managed consistently.

|

| • |

Duplicate handling - A documented process for duplicates, merges, and ownership issues.

|

| • |

Review workflow - Ethical review requests and privacy-safe response templates.

|

| • |

Monitoring - Routine checks for listing edits, suspensions, and policy conflicts. |

What to request: a listings audit sample, a duplicate-resolution note, and a review response escalation process.

Reporting deliverables

| • |

KPI definitions sheet - Stable definitions and exclusions used every month.

|

| • |

Change logs - Timestamped record of updates to ads, pages, listings, and tracking.

|

| • |

Monthly decision notes - A short narrative tying changes to outcomes and next tests.

|

| • |

Monitoring - Alerts and routine checks for tracking failures and downtime. |

What to request: one decision note, one change log excerpt with timestamps, and one example of how a tracking issue was detected and corrected.

Example change log excerpt:

01/08 – Fixed broken internal links and updated redirects after site edits.

01/15 – Rewrote an implant consult page intro to better match “cost and candidacy” queries and added an FAQ section.

01/22 – GBP: updated primary category and corrected hours; documented why with screenshots.

> Back to Table of Contents

Budget and Timeline Reality

Budget sizing is easiest when you start with schedulable capacity and work backward through booking and show rates. Pricing models vary, but the logic stays the same: define what you can schedule, then estimate the lead volume required to fill it.

Common pricing models and what is usually separate

| • |

Retainer - Ongoing execution and optimization, often separate from media spend and some tools.

|

| • |

Project - Defined scope like a site rebuild or listings cleanup, often separate from ongoing management.

|

| • |

Percentage of ad spend - Management tied to spend, while creative and tooling may be separate.

|

| • |

Hybrid - Base program plus add-ons, with clarity depending on what is included. |

A trustworthy proposal separates three costs clearly: execution work, media spend, and tooling.

Conversion-math estimator with variables and one example

| 1. |

Set monthly schedulable capacity for a service line as S appointment slots.

|

| 2. |

Estimate booking rate from qualified leads as B and show rate as H using conservative planning bands.

|

| 3. |

Qualified leads needed = S ÷ (B × H).

|

| 4. |

Estimate CPL as cost per lead based on market competition and channel mix.

|

| 5. |

Budget planning = qualified leads × CPL, plus execution and tool costs based on scope. |

Example: If S = 40 consult slots, B = 0.50, and H = 0.80, then qualified leads needed are 40 ÷ (0.50 × 0.80) = 100. If booking rate improves, you often need fewer leads to fill the same capacity, which reduces front desk load.

Timelines: what stabilizes first and what lags

| • |

Month 1 - Ownership verification, tracking validation, routing checks, baseline capture, early leakage fixes.

|

| • |

Month 2 - Lead-quality refinement, landing page alignment, follow-up SLAs becoming consistent.

|

| • |

Month 3 - Scaling what works with documented, limited-scope changes and clearer explanations of what drove results. |

What not to expect early: perfect certainty, stable trends without stable definitions, or “more leads” automatically becoming “more bookings” without leakage control.

> Back to Table of Contents

Reporting You Can Actually Use

Good reporting supports decisions. It should tie activity to outcomes and make it easy to diagnose quality problems without blame.

KPIs that matter and why

| • |

Qualified leads - Protects the practice from unschedulable volume.

|

| • |

Booked appointments - Connects marketing to the schedule.

|

| • |

Show rate - Reveals expectation-setting and follow-up strength.

|

| • |

Answer rate and callback speed - Explains “phones rang but the schedule stayed flat.”

|

| • |

Lead mix by service line - Prevents emergency volume from masking elective-growth goals. |

A usable monthly summary you can copy

| 1. |

What changed: (3–5 bullets).

|

| 2. |

Why we changed it: (hypothesis tied to intent or leakage).

|

| 3. |

What moved: (qualified leads, bookings, show rate, answer rate).

|

| 4. |

What might distort the data: (staffing, seasonality, outages, policy shifts).

|

| 5. |

What we’re testing next: (1–2 tests and how we’ll monitor). |

Example decision note:

What changed: Added negative keywords for insurance-only searches; updated an implant consult page headline to clarify consult-first; adjusted after-hours routing to voicemail plus text follow-up.

Why: Lead mix skewed to low-fit calls and missed-call recovery was inconsistent.

What moved: Qualified leads down, booking rate up, answer rate stable, callbacks faster.

Next test: Expand high-intent terms; simplify form to reduce duplicates; monitor for 2 weeks.

If reporting does not include exclusions and lead-quality rules, it becomes easy to inflate performance without improving the schedule.

> Back to Table of Contents

Proof That Matters: Case Studies and References

Proof should include context. A credible dental marketing case study explains the starting point, constraints, timeline, and tracking method—not just the outcome.

What a credible case study includes

| • |

Market context - Competition level and location constraints.

|

| • |

Baseline - What visibility, tracking, and conversion looked like before changes.

|

| • |

Interventions - Specific changes made with timestamps.

|

| • |

What didn’t work - Iterations and learning, not only wins.

|

| • |

Outcome chain - Movement in qualified leads, bookings, and show rate where available. |

Mini example: A practice saw “leads” rise month over month, but bookings stayed flat. Call tracking review showed missed-call recovery was inconsistent and “qualified leads” included wrong numbers and existing patients. After exclusions were applied and callback SLAs were implemented, qualified lead volume dropped—but booking rate improved and reporting became stable enough to scale without panic pivots.

Reference questions that reveal trust quality

| • |

Transparency - Did the practice keep admin access and receive clear documentation?

|

| • |

Responsiveness - How predictable is communication and issue resolution?

|

| • |

Under-pressure behavior - What happened when results dipped or tracking broke?

|

| • |

Reputation protection - How are negative reviews handled without privacy risk?

|

| • |

Decision support - Did reporting lead to better actions, not just better dashboards? |

> Back to Table of Contents

Privacy and Reputation Protection in Dental Marketing

This section is educational and US-focused. Rules vary by state, country, and platform, and practices should consult appropriate professionals for jurisdiction-specific guidance.

What HIPAA-aware can mean operationally

HIPAA-aware marketing operations typically aim to minimize protected health information (PHI) exposure, limit access, and document where data flows. Practical examples include keeping PHI out of URLs and event parameters, restricting who can view submissions, and separating booking verification from patient identifiers.

Consent governance for SMS and email

| • |

Capture consent - Store opt-in source, timestamp, and channel so it is retrievable.

|

| • |

Honor opt-outs - Maintain a suppression list and ensure opt-outs propagate across tools.

|

| • |

Limit sensitive details - Keep messages neutral and avoid including clinical specifics.

|

| • |

Document the workflow - Record how consent and suppression are handled during tool changes or staff turnover. |

Privacy-safe tracking and common mistakes to avoid

| • |

PHI in URLs - Symptoms, diagnoses, or identifiers embedded in URLs or thank-you pages.

|

| • |

PHI-like event labels - Overly specific event names that imply sensitive context.

|

| • |

Uncontrolled access - Too many vendors or users able to view submissions or logs.

|

| • |

Overly granular retargeting - Messaging that feels invasive for anxious urgent-care searches. |

Reputation protection during negative reviews or press

| • |

Privacy-safe responses - Avoid confirming patient status or discussing details publicly.

|

| • |

Escalation path - Define who approves responses and when leadership is involved.

|

| • |

Review workflow integrity - Avoid fake reviews, incentivization, and review gating.

|

| • |

Consistency - Keep tone aligned with bedside manner and clinical philosophy. |

> Back to Table of Contents

Discovery Call Trust Test (And What Good Answers Sound Like)

Use questions that test process, transparency, and under-pressure behavior. The goal is to understand how a partner thinks, not memorize a pitch.

Questions that test fit and communication

| • |

Practice fit - How do you learn our clinical philosophy, service mix, capacity, and boundaries for messaging?

|

| • |

Voice protection - How do you prevent ads and content from sounding pushy or salesy?

|

| • |

Week-to-week rhythm - Who is accountable day to day, and how are priorities set?

|

| • |

Internal friction - How do you resolve disagreements between doctors, managers, and operational constraints? |

Questions that test measurement and lead quality

| • |

Definitions - How do you define qualified leads by service line, and what exclusions are standard?

|

| • |

Booking verification - What options exist to validate bookings without exposing PHI?

|

| • |

Tracking integrity - How are GA4 and GTM events defined, tested, and monitored for breakage?

|

| • |

Call tracking - Who owns the numbers, what is the portability policy, and how are duplicates handled?

|

| • |

When results dip - What is the process for diagnosing causes and documenting changes? |

Role-based questions for owner, manager, and DSO

| • |

Owner-dentist - What requires clinical approval, and how are claims and offers kept patient-safe?

|

| • |

Office manager - What operational changes typically improve booking without adding chaos?

|

| • |

DSO lead - How do you balance corporate governance with location-level autonomy across GBP, NAP, and offers? |

> Back to Table of Contents

Red Flags and Contract Terms

These red flags correlate with lock-in, inflated reporting, and reputational risk.

Red flags that justify walking away

| • |

Guarantees without constraints - Rankings or patient counts promised without variability discussion.

|

| • |

No admin access - Refusal to grant or document access to critical platforms.

|

| • |

Undefined lead quality - “Qualified” is claimed without service-line rules or exclusions.

|

| • |

Vanity reporting - Impressions, traffic, or rankings reported without conversion context.

|

| • |

Lock-in tactics - Non-portable accounts or numbers, unclear ownership, withheld exports.

|

| • |

Risky tactics - Spammy links, copied content, fake reviews, incentivization, review gating.

|

| • |

No change control - No QA, no rollback plan, no monitoring cadence. |

Contract terms that reduce risk

| • |

Scope clarity - Deliverables, responsibilities, timelines, and what is out of scope.

|

| • |

Term and cancellation - Notice requirements and transition expectations.

|

| • |

SLAs - Response expectations, meeting cadence, escalation path.

|

| • |

IP and content ownership - Who owns pages, creative, and site assets after termination.

|

| • |

Data portability - Exports, change logs, and documentation provided on exit.

|

| • |

Access revocation - Written process for removing access during turnover or vendor changes. |

> Back to Table of Contents

Selection Process: Compare Agencies Without Guesswork

A simple sequence prevents decision fatigue and makes proposals easier to compare.

| 1. |

Define goals and constraints such as capacity, staffing coverage, services to prioritize, and messaging boundaries.

|

| 2. |

Collect baselines such as lead volume, booking rate, answer rate, visibility, current spend, and tracking integrity.

|

| 3. |

Shortlist vendors based on transparency and dental-specific guardrails such as ownership, lead quality, and reputation protection.

|

| 4. |

Interview using the trust test questions, focusing on process and under-pressure behavior.

|

| 5. |

Compare proposals using the same criteria and requested artifacts, not deliverable volume alone.

|

| 6. |

Start with milestone-based onboarding: access verification, tracking validation, leakage fixes, then scaling. |

A proposal that looks complete but cannot be verified tends to create long-term friction. A proposal that is verifiable tends to create stability.

> Back to Table of Contents

If You Already Have an Agency: A 30-Minute Audit

This audit identifies whether the primary constraint is access, definitions, tracking integrity, or conversion leakage.

| 1. |

Confirm admin access and ownership for domain, GBP, Google Ads, GA4, GTM, Search Console, listings, and call tracking.

|

| 2. |

Verify written KPI definitions, exclusions, and service-line qualification rules.

|

| 3. |

Test conversions end-to-end, including after-hours routing and booking links.

|

| 4. |

Review the last 60 to 90 days of change logs to confirm optimization is documented.

|

| 5. |

Compare leads to booked and showed outcomes to locate leakage patterns.

|

| 6. |

Confirm monitoring exists for downtime, broken forms, and tracking failures. |

If the audit cannot be completed because access is withheld or definitions are missing, trust is structurally limited regardless of tactical skill.

> Back to Table of Contents

Conclusion: Calm Standards Beat Hype

The clearest way to choose a partner is to keep the standards steady: verify access, define lead quality, measure leakage, and require proof artifacts that tie changes to outcomes. That approach reduces internal friction, protects patient trust, and makes fluctuations feel manageable instead of alarming.

This guide is published by WEO Media - Dental Marketing as an educational resource for dental teams evaluating marketing vendors. The standards above are intended to apply to any vendor, including our agency, because the goal is measurable trust: transparent access, patient-safe messaging aligned to the practice’s voice, and reporting that connects lead quality to booked outcomes.

> Back to Table of Contents

FAQs

How do we keep marketing consistent with our clinical philosophy and bedside manner?

Create a voice guide and claim guardrails that mirror how the team speaks in a consult. Define “never say” phrases, require clinical approval for sensitive claims, and QA public-facing copy (ads, GBP posts, review responses) before it goes live.

What KPIs should we track from lead to treatment?

Track the chain with stable definitions: lead, qualified lead, booked, showed, and started care. Apply exclusions for vendors, wrong numbers, and duplicates, then review booking rate and show rate by service line to find leakage.

How do we define a qualified lead for different services?

Define qualification by intent and schedulability. Emergency leads are qualified by urgency and timing. Hygiene leads are qualified by availability and fit. Implants and aligners often require consult intent and education to reduce mismatched price-only inquiries. Cosmetic leads require expectation-setting and consent governance for imagery.

What should we own when working with a dental marketing agency?

At minimum, control the domain registrar and maintain documented admin access to GBP, Google Ads, GA4, GTM, Search Console, listings governance, and call tracking. Clear ownership reduces lock-in and protects continuity during transitions.

How do we verify bookings without exposing PHI?

Use aggregate counts and disposition-based verification instead of patient identifiers. Keep booking reconciliation inside the practice when possible, then share totals and trends by service line. Avoid PHI in URLs, event parameters, and form fields that could be accessed by third parties.

How long does dental marketing take to work?

Early wins are usually measurement and leakage fixes: access verification, tracking integrity, routing, and follow-up SLAs. Lead quality and conversion improvements often follow. Durable organic visibility and predictable month-over-month outcomes typically require consistent execution over time.

What if leads increase but quality drops or price-shoppers dominate?

Diagnose quality using service-line qualification rules and dispositions. Common fixes include tightening intent targeting, expanding negative keywords, aligning landing pages to the query, improving expectation-setting, and strengthening missed-call recovery and follow-up SLAs. Quality should be evaluated by bookings and shows, not call volume alone. |

|

To find a trustworthy dental marketing agency, verify five trust signals before you sign: (1) you have admin ownership of the key accounts, (2) “lead” and “qualified lead” are defined in writing, (3) “booked” is defined in writing, (4) reporting connects leads to bookings with leakage metrics (not vanity metrics), and (5) the agency can show dated proof of work (change logs, QA notes, decision notes) and explain exactly what happens when tracking or listings break.

To find a trustworthy dental marketing agency, verify five trust signals before you sign: (1) you have admin ownership of the key accounts, (2) “lead” and “qualified lead” are defined in writing, (3) “booked” is defined in writing, (4) reporting connects leads to bookings with leakage metrics (not vanity metrics), and (5) the agency can show dated proof of work (change logs, QA notes, decision notes) and explain exactly what happens when tracking or listings break.